Contents

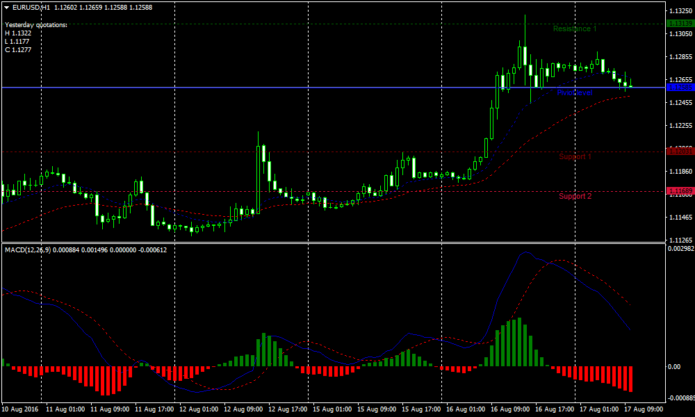

Dla jasności zaznaczyłem początkowy poziom stop przezroczystą czerwoną linią. Niebieskie strzałki oznaczają świecę, w której %b Wstęg Bollingera waha się od 0 do 0,2, a wykres MFI jest tuż poniżej 20. Aby zmierzyć, jak blisko jednej ze wstęg znajduje się cena, użyjemy wskaźnika Wstęg Bollingera %b.

Koperta jest jednym z najstarszych wskaźników analizy technicznej. Została zbudowana na podstawie prostej średniej ruchomej i dwóch wstęg położonych w równej odległości od tej linii środkowej. Trade Broker Forex przez Broker Forex Podobnie linie Bollingera na wykresie są rysowane według wzoru opisanego powyżej. Sygnał sprzedaży pojawia się, gdy cena przecina prostą średnią kroczącą w dół i pozostaje poniżej niej.

Im bardziej zwęży się wstęga tym większa szansa na wybicię się cen. Wstęga Bollingera jest jednym z bardziej intuicyjnych wskaźników stosowanych w analizie technicznej. Jest często stosowany przez traderów, którzy lubią trend boczny i grę „od bandy do bandy”. Może być też również stosowany przez grających zgodnie z trendem szukając miejsca zakończenia krótkoterminowej korekty trendu wyższego rzędu. Dnia 14 listopada nastąpiło wybicie wstęgi, które okazało się fałszywe.

W tym przypadku trzecie pchnięcie nie dotyka górnej wstęgi Bollingera. W takim przypadku ujemny %b jest możliwy wtedy, gdy cena wychodzi poza niższe wstęgi Bollingera. Sygnał ten można zinterpretować zarówno jako znak wyprzedania aktywów, jak i znak odwrócenia trendu.

Trzeba jednak zastrzec, że w praktyce metodę taką należy stosować wyjątkowo ostrożnie, na pewno nie w automatyczny sposób. Kontrariańskie sygnały sprawdzają się bowiem wyłącznie w czasie trwania trendu bocznego, kiedy notowania mają to do siebie, Jak poprosić przyjaciół i rodzinę o sfinansowanie firmy że kołyszą się w górę i w dół. Konkretne sygnały transakcyjne są konsekwencją tego, że górną linię wstęgi traktuje się jako poziom oporu, a dolną jako wsparcie. Z tego założenia wynikają wprost dwa alternatywne podejścia inwestycyjne.

Dalsze przesuwanie zlecenia stop w kierunku formowania się świecy przyniesie zysk po uruchomieniu zlecenia. Na otwarciu kolejnej świecy wchodzimy na rynek z pozycją kupna w wysokości 1,08752 pkt . W obszarze wykresu zaznaczonym niebieskim owalem świeca przecina dolną wstęgę. Tutaj linia K przecina D, a sam Stochastyczny pokazuje wyprzedaż poniżej poziomu 20%. Stop loss jest ustawiany z przesunięciem co najmniej 10–20 punktów od niżu świecy wybicia w przypadku pozycji długiej i wyżu w przypadku pozycji sprzedaży. Ustaw take profit na przeciwległej wstędze Bollingera.

Czym jest wskaźnik Wstęg Bollingera na Forexie

W trendzie wzrostowym powinniśmy szukać okazji do kupna. W przypadku konsolidacji w grę wchodzi zarówno zajmowanie pozycji długich jak i krótkich. Pozwalały one ochronić większą część papierowych zysków w porównaniu z późniejszymi sygnałami wysyłanymi przez samą wstęgę.

W tym przypadku, dolna wstęga staje się poziomem docelowym. Rdzeniem wskaźnika jest przysłowiowe „ABC” analizy technicznej, czyli zwykła średnia krocząca z „n” sesji (najczęściej w praktyce wykorzystuje się średnią 20-sesyjną). Cechą wyróżniającą wstęgę Bollingera na tle innych wskaźników technicznych jest sposób, w jaki ta średnia jest wykorzystywana do dalszych obliczeń. Połączył w ten sposób elementarne pojęcia wykorzystywane przez analityków technicznych (czyli średnią), jak i przez znawców teorii finansów i statystyki matematycznej.

Mistrzowie rynków finansowych

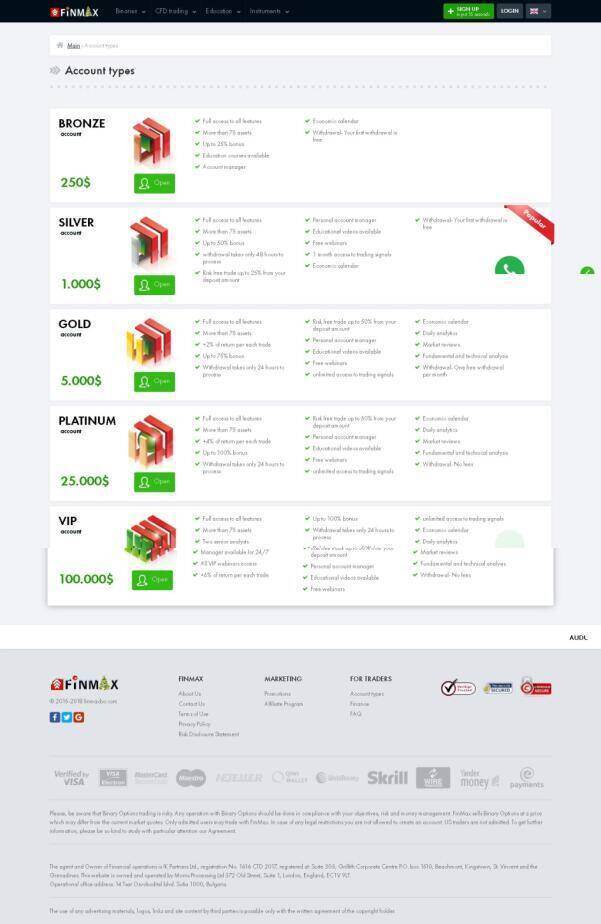

W okresach o dużej zmienności rozszerzają się, a w okresach małej zmienności zacieśniają się. Kontrakty CFD to złożone i bardzo ryzykowne instrumenty, mogące spowodować szybką utratę kapitału ze względu na dźwignię finansową. Od 67% do 89% inwestorów traci swoje środki handlując CFD. Musisz rozważyć, czy jesteś w stanie ponieść ryzyko utraty zainwestowanych środków.

Ogólnie przyjęło się, że gdy cena dotyka górnej wstęgi to jest to sygnał sprzedaży oraz odwrotny przypadek to gdy cena dotyka dolnej wstęgi to jest to sygnał kupna. Wstęgi Bollinger’a absolutnie nie powinny być używane w ten sposób. Wstęgi Bollingera na wykresieSięgając do definicji odchylenia standardowego możemy przeczytać, że przedstawia ono rozproszenie wokół wartości średniej. Przy zastosowaniu wartości domyślnych wstęgi (średnia 20 okresowa, 2 odchylenia standardowe), 95% cen powinno znaleźć się pomiędzy dwiema wstęgami. Większość dostępnych obecnie programów do analizy technicznej pozwala automatycznie nanosić na wykres wstęgi Bollingera, więc nie musimy ich obliczać samodzielnie. Dobór okresu i rodzaju średniej, krotności odchylenia standardowego oraz horyzontalne przesunięcie wszystkich linii wskaźnika.

W tym momencie publikowane są wiadomości poprzedzone plotkami i oczekiwaniami. Na prawym ramieniu lub ostatnim skoku w górę widać niewielki przypływ optymizmu. Najczęstszym przypadkiem potrójnego szczytu jest wzór głowy i ramion, który jest dobrze znany w analizie technicznej. Potem następuje kolejny okres wzrostu, który tworzy nowy szczyt kończący się jeszcze większym cofnięciem.

W praktyce najczęściej bardziej rozsądne i opłacalne okazuje się stosowanie wstęgi Bollingera nie jako narzędzia kontrariańskiego, lecz wręcz przeciwnie – jako metody podążania za trendem. Także to podejście bazuje na założeniu, że górne ograniczenie wstęgi to opór, a dolne to wsparcie. Przebicie oporu traktuje się jako oznakę trendu wzrostowego i sygnał do zajęcia długiej pozycji lub zamknięcia krótkiej. Przebicie wsparcia z kolei to sygnał do zajęcia krótkiej pozycji lub zamknięcia długiej.

Budowa wskaźnika

Druga linia, czyli środkowa, to często średnia krocząca z okresów, głównie ceny. I wreszcie dolna granica jest również produktem ubocznym obliczania odchylenia standardowego ceny. Tylko tym razem zamiast wykonywać dodawanie, wartości średniej ruchomej są odejmowanie. Kontrakty CFD są złożonymi instrumentami i wiążą się z dużym ryzykiem szybkiej utraty środków pieniężnych z powodu dźwigni finansowej. 82% rachunków inwestorów detalicznych odnotowuje straty pieniężne w wyniku handlu kontraktami CFD u niniejszego dostawcy CFD. Podejmując decyzje inwestycyjne, powinieneś kierować się własnym osądem.

- W sprawie informacji stanowiących rekomendacje dotyczące instrumentów finansowych, lub ich emitentów (Dz.U. z 2005 r. Nr 206, poz. 1715).

- Pozwala dokładnie zidentyfikować strefy kupna, sprzedaży i realizacji zysków.

- Wstęgi są położone dwa odchylenia standardowe od średniej kroczącej.

- Ustaw stop loss i czerp zyski podobnie jak w przypadku długich pozycji.

Zadaniem wstęg jest określanie względnych dołków i szczytów cenowych. Czyli według definicji cena osiąga szczyt przy górnej wstędze, a dołek przy dolnej. Gdy cena jest u szczytu, akcje warto sprzedać i odwrotnie – gdy jest w dołku warto kupić. W przeszłości skutkowało to znacznymi ruchami na plus. Jednak te ruchy zmniejszały się, zwiększając zamiast tego szanse na odwrócenie.

Jak w Poprawnie Stosować Wstęgę Bollingera

W rezultacie otrzymasz listę odchyleń od średniej ceny. Niektóre z tych wartości będą miały wartości dodatnie, inne będą ujemne. Ogólna zasada jest taka, że zakres odchyleń jest wprost proporcjonalny do stopnia zmienności szeregu.

Zlecenia stop są ustawiane na szczycie świecy z przesunięciem dwóch słupków od miejsca otwarcia pozycji. Jednym z takich systemów handlowych jest strategia przebicia Bollingera. Jest równie skuteczny zarówno w przedziałach Brazylijska kruszarka sojowa Imcopa może sprzedawać rośliny na aukcji w grudniu 4 5-minutowych, jak i tygodniowych. Strategia ta jest całkowitym przeciwieństwem strategii odbicia wstęgi Bollingera. Założycielem strategii przebicia jest Bruce Babcock, autor teorii handlu intuicyjnego.

Tworzą początek lub koniec złożonych segmentów dużej figury. Jeśli niż z prawej strony znajduje się niżej niż ten z lewej strony, takiej sytuacji towarzyszy strach i dyskomfort ze strony mas zwykłych traderów. Wielu z nich długo utrzymywało się na poprzednim niżu i zostało wyrzuconych z rynku.

Skopiuj niezarchiwizowany plik Bollinger_Bands_3b.mq4 do tego katalogu i zrestartuj terminal. Wielu ekspertów zgadza się z tym, że najbardziej skuteczne są strategie oparte na sygnałach przebicia. Wskaźnik Wstęg Bollingera jest jednym z najlepszych wskaźników do śledzenia i przewidywania przyszłych impulsów. Rooney, analityk techniczny i trader z dziesięcioletnim doświadczeniem, zdobywca nagrody za napisanie systemów handlowych. Najpierw dodajmy wstęgi Bollingera i RSI do wykresu EURUSD na terminalu online LiteForexu. Aby to zrobić, kliknij przycisk „Wskaźniki” znajdujący się na górze wykresu.

Jedno z nich zakłada, że jeśli ruch zatrzyma się na oporze bądź wsparciu, to dojdzie do jego odwrócenia. To pozwala na obranie taktyki przeciwnej do wydarzeń na rynku. Przykładowo, wraz ze wzrostem kursu do górnej linii wstęgi można otworzyć krótką pozycję, obstawiając, że notowania nie zdołają pokonać oporu i dojdzie do odbicia w dół. Skoro znamy już zasady budowy wstęg, to czas wreszcie przejść do sposobów ich interpretacji. Podstawowa metoda wynika z faktu, że wskaźnik ten pokazuje aktualną zmienność notowań.

Z całego wykładu, w którym uczestniczyłem najbardziej odkrywcze było dla mnie w jaki naprawdę sposób wstęgi Bollinger’a generują sygnały kupna i sprzedaży. Jest to interpretacja na jaką nigdy wcześniej nie trafiłem w żadnej innej literaturze. Jednak wnioski jakie płyną z tych obserwacji mogą być różne.

Informuje tylko gdzie cena znajduje się względem zakresu zmienności. Jej powstanie wynikało obserwacji, że zmienność cen nie jest statyczna a dynamiczna. W takim razie można spróbować określić względny obszar, w którym cena będzie poruszać. Wstęga wykorzystuje odchylenie standardowe jako miarę statystyczną, która określa możliwy poziom wsparcia oraz oporu. Wstęgi Bollingera należą do najbardziej niezawodnych i skutecznych wskaźników, z których może korzystać z trader. Mogą być one wykorzystywane do odczytywania sygnałów rynku i siły trendu, oraz planowania wejścia w trakcie konsolidacji oraz znajdowania potencjalnych szczytów.

Aby utrzymać pokrycie na poziomie 88-89%, wstęgi Bollingera powinny być wykreślane przy użyciu współczynnika 1,9 dla okresu 10 słupków. Oznacza to, że skracasz szerokość wstęgi z 2,0 do 1,9. Z okresem odpowiednio 50 słupków należy zwiększyć szerokość z 2,0 do 2,1. Są one wykreślane na podstawie procentowego przesunięcia od niebieskiej średniej ruchomej. Głównym celem wskaźnika Wstęg Bolingera jest określenie gwałtownego odchylenia od średniego kierunku aktualnego trendu. Wstęgi Bollingera są wskaźnikiem dynamicznym, dzięki czemu bieżąco dostosowują się od warunków rynkowych.

Recent Comments