The purpose of the study is to assess the influence of customer satisfaction on market penetration strategy of agency banking at Cooperative Bank of Kenya in Nakuru Town. A descriptive survey design was used, with the sampling frame comprising the 400 clients who access the agency banking services of Coop KwaJirani outlets in Nakuru Town. Data was analyzed with the aid of the Statistical Package for Social Sciences . Different versions of the marketing mix model may incorporate other P’s, such as process and positioning. Process describes the start-to-finish effort involved in building and marketing a product, from conception and production to sales and final delivery. Positioning describes how a customer understands the product, its brand, and its benefits. In digital stores, the user interface and search function of a site play an important role in whether a customer can find a product or not.

An above average market penetration rate for consumer goods is estimated to be between 2% and 6%. In this case, it may be wise to partner up or acquire a competitor to unify your customer base and resources. Sometimes joining forces with another business is the most viable path for small business growth. Depending on your business type, partnerships might provide extra resources in terms of manpower, skill sets, knowledge, equipment, or technology. Or it simply might enable both businesses to expand into new markets without directly competing with each other. Perhaps the product’s value proposition and key messages no longer resonate with your current market. The average rate of market penetration for consumer products can be anywhere between 2% and 6% of TAM.

Make great customer relationships an everyday reality.

However, these tactics will implement best when you use multiple tactics together. Like increasing https://quickbooks-payroll.org/ the reach of the product should like be accompanied with increasing the promotions.

For instance, the global market penetration rate of smartphone brands like Apple, Samsung, Huawei, Oppo, and Xiaomi is 19.2%, 18.4%, 10.2%, and 7%, respectively. The suitable market penetration rate relies on your TAM and product category. If you’re sure about your target market, put the values in the abovementioned formula, and you’ll get the market penetration. No matter what type of market penetration strategy a company chooses, there are a few things to keep in mind to succeed.

The more someone uses your product, the higher the odds of feature discovery and adoption. However, it’s crucial that you factor in customer preferences and utilize customer segments to keep your in-app marketing relevant to each user type otherwise it’ll come off as white noise. A 5-Step Guide to Building Your Own User Personas If you could describe your typical user, who would they be? Learn how to create your own with these examples and a free user persona template to guide your product teams toward the right customers. When you’re creating a growth strategy for your business, let those top performers that came before you be a benchmark for internal KPIs.

How to Calculate Market Penetration Rate?

It is primarily used to determine the effectiveness of a business’s marketing strategies and paves the way for improvement that is meant to yield an increase in profits. The focus of market penetration is increasing the sales for an existing product in an existing market. On the other hand, the focus of market development is using existing products to enter a new market. As you can see, effective marketing comes down to understanding where your user needs to be and crafting an experience to help them get there. If you utilize the growth strategies we’ve covered in this article then you’re sure to see product expansion and business growth across your entire organization. A diversification strategy is a growth plan that means businesses will enter new markets with a new product. Market penetration strategy uses for company growth by increasing sales of the current product to the current market with changing the product.

What are the 7 Ps of marketing mix?

It's called the seven Ps of marketing and includes product, price, promotion, place, people, process, and physical evidence.

Start with high-level goals, like where you want your company to be in 5-10 years, how much revenue you want to generate, and how many employees you want to have. Then, reverse engineer those big goals into smaller goals that you’ll need to hit in 3-5 years in order to achieve those higher-level goals. Next, break those goals down into 1-3 year goals before getting into the weeds a bit with your 6-12 month goals. Lowering Industry Prices – Market penetration strategy can harm the entire organization. Improving Products – The best practice of engaging and interacting with customers is to inform them that your product has changed to better. Nike uses its popularity to encourage other people to purchase their clothing apparel. This company also incorporates different athletes to encourage their fans to buy their shoes.

Create a customer experience map

Entering into a new geographical market– Despite the promising returns, this strategy requires proper analysis and careful considerations. As such, brands must ensure they grasp the needs of the new market, demand, competitors, pricing and market growth rates before diving into the investment. Increase the distribution channels– One of the main reasons why customers opt to try other products is the unavailability of their products of choice.

St but certainly not least, a business will need to establish an account management framework if its ultimate goal is boosting its penetration percentage. By definition, account management is the process of building a long-lasting partnership with your existing customers. However, if you really want to reap more rewards for your services, targeting enterprise clients can be very lucrative. When it comes to sales, never dismiss opportunities before looking into them.

- As previously mentioned, in order to do this effectively it’s important you study where your competitors products are currently struggling.

- By reviewing their market penetration, BBB was able to identify a small, existing market they could tap into — kids’ leggings.

- Resellers purchase products from manufacturers at a discounted rate and sell them at a higher price to make money out of the transaction.

- Plan, fund, and grow your business Achieve your business funding goals with a proven plan format.

- This strategy is essential for a company as it determines in advance whether a new product/service will get any market share or not.

- For example, if Apple sells its products to a country that houses one hundred million people but only fifty million own Apple products, then fifty million people are yet to experience these products.

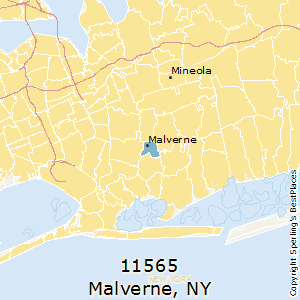

After determining the product’s consumers’ demographic profiles, determine the target market’s total size. The formula for market penetration is the number of people who wear a watch versus the total target group .

Resources: Products and Services in Marketing Strategy

Ultimately, businesses need to remember that fun and productivity aren’t mutually exclusive. Most successful companies need to diversify their product line if they hope to stay relevant in existing markets and enter new markets.

However, there are some tips for creating a growth plan that should come into play no matter your business model, or the growth trajectory you’re shooting for. Thread these tips into your product launch roadmap or new business plan. Despite its questionable profitability in recent years—currently scraping a 7% growth rate from 2018—there’s no doubting the business’s viral growth. Back in September 2008, Dropbox had 100k registered users; the following year, that jumped to a whopping 4M registered users. They achieved an astonishing 3900% growth in 15 months with a succinct growth plan. An acquisition can help your brand own a new product or a feature that’s already in line with what your customers want and need.

Market penetration strategy examples

Or something as large as relaunching marketing campaigns or creating a loyalty program. As you conduct your market analysis and begin to map out specific steps, here are a few market penetration strategy examples you can try to implement. Customers save time, money, and potential construction delays by eliminating the need to find and contract with separate providers. These segments allow you to create highly targeted and personalized campaigns that have a much higher chance of success.

- It indicates the firm’s efforts for expansion by current commodities in the present marketplace.

- Every day shoppers can purchase items in one of its warehouses at lower prices than other big-box retailers or department stores.

- Sometimes a business identifies a customer need that no product or service attempts to fill, offering the opportunity to develop an innovative solution.

- One of our customer success representatives will be in touch with you shortly.

- It also collaborated with IBM to incorporate AI into fitness and sleep tracking.

Some companies and marketing individuals chose to use both definitions in order to gain a more precise understanding behind the effectiveness of the strategies they use. For business products, the average market Six Tactics For Market Penetration Strategy penetration ranges between 10% to 40%. Find the market penetration definition, how to calculate it, examples and strategies. Let’s say a hair care retailer generates $50,000 in revenue from its 1,000 shoppers.

What are the four types of growth strategies?

For example, a product can be marketed across different media (YouTube, television ads, mobile ads, etc.) to convey the same message across all channels. A marketing plan serves as a guide towards the ultimate marketing objective of a company. Considering the numerous elements of a marketing plan, in this article, we deal with a specific one from the mix, i.e., Market Penetration.

Hence, a business should give special consideration to conducts it, since this strategy is important for the evaluation work on the intended market and the existing businesses within this market. The amount of risk involved with each of the four types of Ansoff’s strategies increases from market penetration to market development, to production development, to diversification. Because the both market and product development involve with one aspect of new developments, changes, and innovation. The diversification strategy is with most risk because the business is growing into both a new market and product, and thus contains with most uncertainties.

Price penetration is most effective in case of High price elasticity of product, extensive economies of scale, High demand of product, and suitability of product for mass marketing. Improvising the uses of an existing product– This enables brands to hunt for more customers. Customer interviews can reveal different ways in which they use the same product.

What are 5 marketing tactics?

The 5 areas you need to make decisions about are: PRODUCT, PRICE, PROMOTION, PLACE AND PEOPLE. Although the 5 Ps are somewhat controllable, they are always subject to your internal and external marketing environments.

However, a good penetration rate if it is significantly higher than the other competitors in the industry. Some companies result to lowering their production price to lessen the number of customers to breakeven. They will multiply the number of consumers by the ranges stated to get the normal market penetration. The company usually estimates the percentage from careful and calculated data from past experiences. Startups, however, use data from other companies to calculate the average percentage range for their product.

With the onset of the digital era, ecommerce and online marketing channels have made it a lot easier for retailers to reach their customers quickly. Engaging in a price war works well in markets where customers are price sensitive but it’s important that you keep in mind the average income of the target market.

So, the first step in developing an effective strategy is to analyze the existing products and the current leaders in your niche. Try to get the market penetration percentage and see what they are doing to get their recent results. This step may take some time as you will have to visit the market and gather information about your competitors. A good market penetration rate will vary depending on the type of industry the product or service falls under. Studies have shown that the average market penetration for consumer products and services falls between 2-6%.

- There are multifaceted benefits that are linked to a cost leadership strategy undertaken by firms.

- Despite its simplicity, more effort must go into analyzing these statistics to make the best decision for their marketing strategies.

- For some organizations, it is difficult due to one or more reasons to enter new markets.

- Here are the top strategies you can implement to positively impact your marketing and improve your penetration ratio.

- You already know the market for your product exists and how it responds.

- An effective way to do this is to properly communicate with the customers and be sensitive to their requirements and wants.

According to Statista, McDonald’s has established a total of 39,198 restaurants in the global market through the franchising strategy. The franchising strategy helps McDonald’s to not only increase its market presence but also helps the company to build up a strong customer base with ease of purchase and accessibility. This quantitative measure of penetration is expressed in terms of percentage. The subsequent section puts forth a thorough elaboration on market penetration rate and its calculation.

Courses

The first step of every marketing process is to engage in market research. It aids in understanding the complexity with which the market operates and also the needs and wants of customers. Under Armour executed this strategy by increasing its promotion of their products to the women consumers via stellar ad campaigns like the ‘I will what I want’ campaign. Companies prefer partnering with influencers to spread the word around about their products. Famous personalities having massive followers on social media platforms can influence the sales of a product.

Recent Comments